Life Without Health Insurance: "We're the Serfs of the Doctors"

- Written by Bernhard Albrecht

- ~ 10 Min Read

Unforeseen Loss of Health Coverage: Reasons It Could Catch Anyone Off Guard - Unforeseen loss of medical coverage?

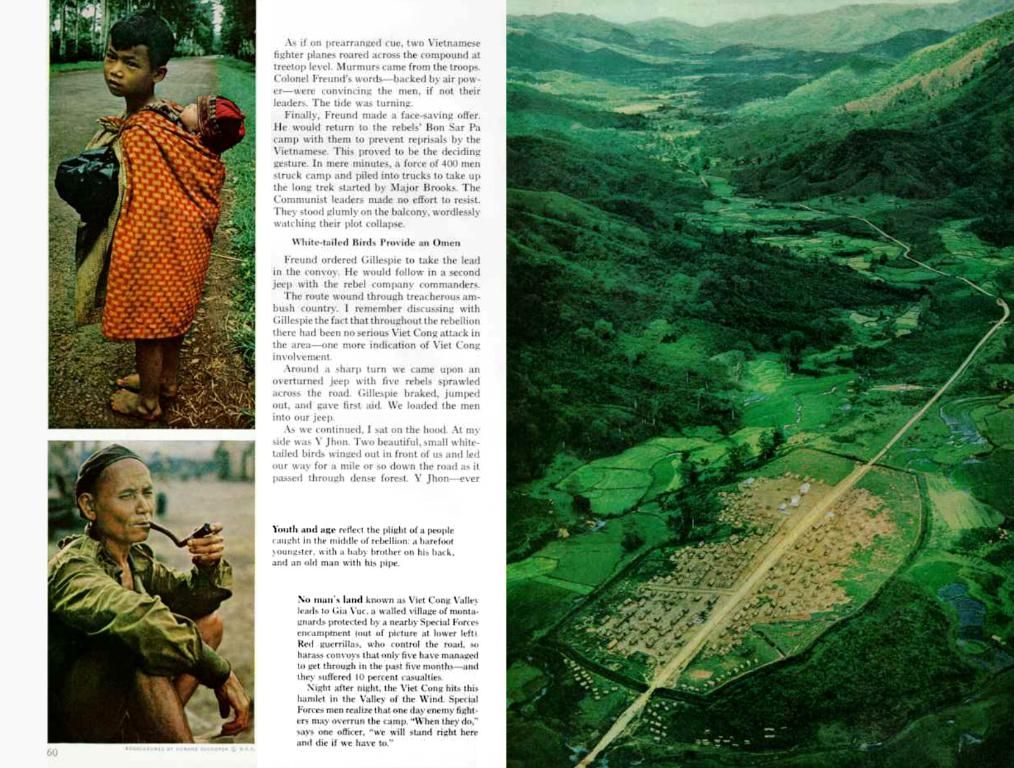

Three individuals share a startling similarity - they lack health insurance: 73-year-old actor Heinz Hoenig, 22-year-old Constantin S, and his mother Cornelia, who lives in poverty.

The consequences of their uninsured status have been widely publicized since April of last year, when Hoenig flew to the brink of death, spending five months in various hospitals. The expenses surpassed €100,000, which his family could only cover with donations from his fans.

Unlike Hoenig's family, no one contributes to the S's, a family who could be ruined by a serious illness requiring costly treatments. Their meager income for years, coupled with a series of unfortunate circumstances, has prevented them from qualifying for social assistance.

After Cornelia S reached out to the stern via email, the author had a chance to visit the S family twice - discovering no improvements in their precarious situation. Cornelia shared her sentiments, "It's not only the homeless or those seeking opt-out from solidarity who are affected, but individuals like myself and my family."

In Theory, "No One" Should Be Without Insurance... But There's a Catch

Ideally, scenarios like the S family's should not exist within the German healthcare system. The law necessitates that every German citizen secure coverage from a health insurance company or private insurance. This obligation guarantees a right; the government protects against policy cancellations that would leave individuals uninsured. The legislation was established between 2009 and 2013. Yet, every law harbors exceptions. The S family slipped through one of these, resulting in a bitter reality.

- Health Insurance

- Health Insurance Provider

- Medical Mistake

- Medical Visits

In practice, however, there are cracks in the system. According to various sources, falls into the uninsured category like the S family may occur in several ways:

- Income Ceiling: High-earning employees can opt for private insurance, resulting in elevated costs for those with pre-existing conditions or older adults, potentially driving some uninsured if the expenses are unaffordable [1][3].

- Self-Employment and Freelance: Freelancers and self-employed individuals procure their insurance, deciding between public or private plans. High-earning freelancers might face exorbitant premiums, while individuals with pre-existing conditions could struggle to find affordable private insurance [1].

- Transition Gaps: During career shifts, such as moving from employment to self-employment or unemployment, individuals might face temporary insurance gaps [2].

- Adverse Selection: Private insurance can be pricier for high-risk individuals, potentially generating a downward spiral where low-risk individuals opt out, resulting in higher premiums for the remaining individuals [4].

- Complexity and Bureaucracy: The system's intricacy and prolonged bureaucratic processes can lead to confusion and delays in obtaining coverage, especially for expats or those unfamiliar with the system [1][3].

These challenges pose issues, even for a country renowned for its comprehensive healthcare system. Such complexities can cause individuals to fall through the gaps in health insurance coverage, despite the system's overall comprehensiveness.

- The community policy should address the gaps in health insurance coverage to ensure no one like the S family slips through.

- Vocational training programs could help self-employed individuals navigate complex insurance options and understand their rights.

- The science behind chronic diseases, such as chronic kidney disease, cancer, and respiratory conditions, could be integrated into workplace-wellness programs to promote early detection and preventative care.

- Medical-conditions and chronic diseases require proper nutrition, making it important to include nutrition education in health and wellness initiatives.

- Fitness and exercise, alongside mental health support, can play crucial roles in managing medical conditions and improving general health.

- Eye-health, hearing, and digestive-health should also be prioritized in health insurance policies to ensure comprehensive coverage.

- Wealth management and personal finance resources could help families facing illness manage their expenses and savings, while debt-management and budgeting skills could assist in debt reduction.

- policy-and-legislation should be reviewed to remove unnecessary exceptions that lead to individuals falling through the cracks of health insurance coverage.

- Specific policies could be introduced to support those who face medical-visits and expenses due to medical mistakes.

- Vocational training in sectors such as neurological disorders, cardiovascular-health, and skin-conditions could help individuals secure stable employment despite their health issues.

- Financial assistance programs could be established to help families in poverty manage expenses during medical crises, as was the case with Heinz Hoenig.

- Education on health-and-wellness, including screenings for hidden medical-conditions, could be provided as part of general-news media to eliminate misunderstandings and promote awareness.

- Whether caused by car-accidents, war-and-conflicts, or other accidents, insurance policies should cover people battling medical-conditions and their recoveries properly.

- Government agencies and health insurance providers should work together to simplify the application process and reduce bureaucratic delays in obtaining insurance coverage.

- Crime-and-justice and accidents can lead to financial ruin without proper insurance, emphasizing the need to ease access to affordable health insurance for all.

- Fire departments and other emergency services should be included in community discussions about health insurance policies, as they often have to deal with the immediate medical needs of uninsured individuals.