Boston Scientific plans to acquire Sonivie for as much as $540 million

The renal denervation market is on the rise, with a projected growth from $0.55 billion in 2024 to $2.28 billion by 2029, according to recent reports. This growth is driven by factors such as increased hypertension incidence, advancements in clinical research, and improvements in regulatory environments.

In the competitive landscape, major players like Medtronic, Boston Scientific, and ReCor Medical are at the forefront. Medtronic is researching multi-organ denervation, while ReCor Medical offers the Paradise ultrasound renal denervation system. The market's future growth is anticipated to be robust, driven by technological advancements, regulatory changes, and a focus on less invasive procedures.

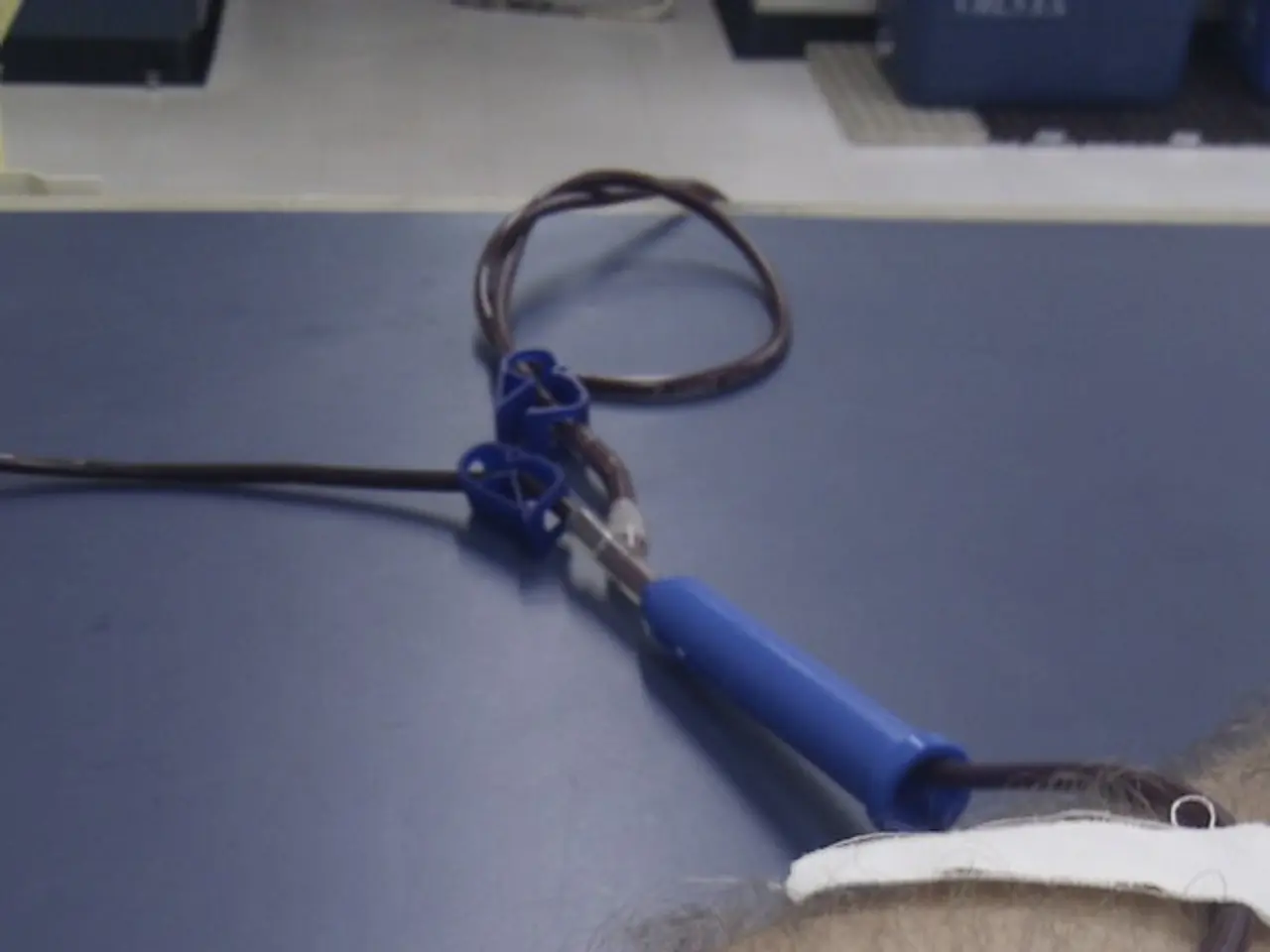

Boston Scientific's strategic moves, such as the acquisition of Sonivie, are part of its broader strategy to expand its portfolio in the renal denervation segment. The deal, expected to close in the first half of 2025, is seen as a move to catch up with initial market entrants. Sonivie's Tivus system uses ultrasound energy for renal denervation, potentially allowing for deeper tissue penetration and faster procedures.

The acquisition of Sonivie could enhance Boston Scientific's capabilities and market position by integrating new technologies. However, specific details about the impact of this acquisition on the market competition are not yet clear. Boston Scientific will make an upfront payment of approximately $360 million for the remaining 90% stake in Sonivie, with potential regulatory milestone payments of up to $180 million.

The Centers for Medicare and Medicaid Services (CMS) began a national Medicare coverage analysis for renal denervation devices in January, with completion expected in October. J.P. Morgan analysts have expressed interest in the renal denervation market, citing its large size and limited alternative treatments.

Boston Scientific's recent acquisitions, including Axonics, Silk Road Medical, and Bolt Medical, indicate its commitment to expanding its presence in the medtech industry. The company's position as one of the industry's biggest spenders over the past year underscores this commitment.

The renal denervation market is set for continued innovation and growth, with Boston Scientific's acquisition of Sonivie and similar moves by other companies contributing to this competitive landscape. The integration of AI and machine learning, along with telehealth and remote monitoring, is expected to further enhance the market's potential.

- In the renal denervation market's competitive landscape, Medtronic, Boston Scientific, and ReCor Medical are leading players.

- Medtronic is focusing on multi-organ denervation research, while ReCor Medical offers the Paradise ultrasound renal denervation system.

- The robust future growth of the renal denervation market is attributed to technological advancements, regulatory changes, and a focus on less invasive procedures.

- Boston Scientific's strategic moves, like the acquisition of Sonivie and Axonics, Silk Road Medical, and Bolt Medical, show their commitment to expanding in the medtech industry.

- The CMS began a national Medicare coverage analysis for renal denervation devices in January, with completion expected in October.

- J.P. Morgan analysts have demonstrated interest in the renal denervation market due to its large size and limited alternative treatments.

- The integration of AI and machine learning, along with telehealth and remote monitoring, is expected to further boost the renal denervation market's potential, contributing to its continued innovation and growth.